Pre-Seed Funding for Wellness Businesses: What You Need to Know

As your wellness business expands, you will most likely need additional funding to take it to the next level. Seeking investors and offering them a stake in your company in exchange for funding is a great option.

Startups and new firms have immediate equipment, office space, and personnel needs. To accomplish these goals, they will nearly always require additional cash. Here comes the role of seed money and pre-seed money for entrepreneurs.

In other words, the whole process of getting a business off the ground requires one thing: finance. There is an astonishingly high probability of failure in pushing a product or service to market without adequate money. Because there are several investment rounds, the terminology used can be difficult to understand for first-time companies.

Many wellness business owners and entrepreneurs are already aware of the concept of seed money, but it’s just as important to understand pre-seed fundraising. When investors are confident in a company’s business plan, pre-seed capital may be preferred over seed funding.

To ensure your wellness, skincare, and cosmetics brand looks its best when seeking pre-seed funding, Aventive Studio can create your brand strategy, visual identity, packaging designs, and website to stand out from the crowd and impress your future investors.

What Exactly Is “Pre-Seed” Funding?

Early on in the funding process, before seed funding or any other subsequent stages, is when pre-seed investment typically takes place. To get their businesses off the ground, pre-seed investors put up capital in exchange for an equity stake.

This could be the final step of funding your wellness brand after the firm has been established with the help of earlier rounds of fundraising, such as bootstrapping using the owner’s own money or the first round of angel investments.

Due to the fact that most products have not yet been created and organizations may just have a prototype, pre-seed investment typically means investing in an idea. It’s rare for a pre-seed round of investment to reach the threshold of being considered a “real” funding round.

However, this inflow of capital is essential for certain entrepreneurs to lay the basis for anything major that has the potential to upend the sector.

Pre-seed funding is critical for laying the groundwork for launching a business and ensuring its long-term success.

Top 5 Pre-Seed Funding Types

A rather wide number of options are available for raising money before a seed round. The first step in the pre-seed round is researching the various funding opportunities available to entrepreneurs.

Most conventional financial institutions are not in the business of investing in new ideas, which is why many would-be entrepreneurs are taken aback by the scarcity of pre-seed funding opportunities. Investors wait for founders to pursue seed capital because they want to make sure the business has a chance of succeeding.

Let’s take a look at the common ways to raise first funding:

Crowdfunding

There are currently over 500 crowdfunding sites available in which people from all around the world contribute considerable amounts to fund a project. These methods work, but they rely largely on brand promotion to generate buzz.

Incubators are organizations that help new businesses get off the ground by providing a variety of resources beyond merely funding, such as classroom instruction, office space, and introductions to potential investors.

Family and Friends

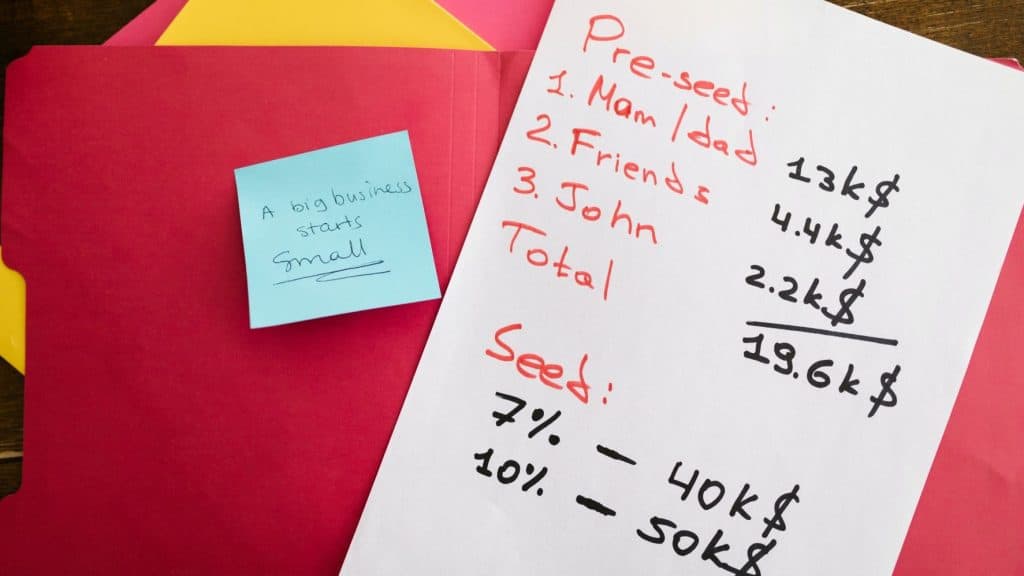

By a large margin, the most common source of investment for pre-seed firms is family and friends. The majority of startup capital comes from the creator themselves or from their close circle of friends and family.

Venture Capitalists

These investors seek out promising new businesses at their earliest phases of growth. Keep in mind that venture capitalists are notoriously picky investors with a low rate of success.

Angel Investors

Angel Investors are affluent people who back new businesses. Pre-seed angel investors are usually willing to take substantial risks, allocating an average of $100,000 to firms in this stage of their development.

Accelerators

Accelerators prioritize rapid expansion for promising concepts. Although most accelerators don’t provide funding until after a firm has proven itself, some do so for “pre-seed” companies.

How Does Pre-Seed Funding Vary From Seed Funding?

There is some overlapping terminology between the pre-seed round and the seed round. In both cases, the founders are seeking funds to develop a product that has not yet been proven successful in the marketplace.

Pre-seed funding occurs before seed money. Pre-seed fundraising is the investment in an idea; therefore, that’s the quickest way to tell them apart. It’s a gamble on a commodity that hasn’t yet been accepted by consumers. In contrast, seed investment is sought by investors for products that already exist and have established client bases.

Pre-seed capital is more difficult to come by than seed funding because it is a gamble on the viability of an idea. Investors take on a higher degree of risk when funding a pre-seed stage venture, as there is no guarantee the product will ever reach consumers.

No matter how you obtain your funding, you need to ensure you have a solid brand strategy in place to assure investors that your products can generate sales and stand out in the wellness, cosmetics, or skincare market.

When Should Wellness Founders Pitch For Pre-Seed Funding?

There is no foolproof method for determining whether it is appropriate to seek pre-seed funding for a company, but there are a number of important factors to bear in mind:

- You’re seeing some interest in your minimal viable product, but you need money to keep it from stagnating.

- You have found a market need that needs filling, and you have evidence that this need can be met by your solution.

- A solid foundation has been laid, but in order to sustain growth, you will need to fill key positions with new recruits.

Revenue generation activity is a positive sign. The majority of firms fail to gain traction from customers until well after the seed stage. Investors want to see proof that people are willing to pay for your product.

Why Do Wellness Founders Need Pre-Seed Support?

There are three primary uses for pre-seed funding:

- To develop a viable business concept

- To initiate product or service development from the concept stage

- To continue market, technology, and product research and development

Indicating to founding teams that early-stage investors are interested in the concept and prepared to rely on the team growing it out is the goal of pre-seed financing. Founders can use interest and support data to strengthen their networks and get larger investments once they’ve seen the idea confirmed by early adopters.

Startups that receive investment before their products are ready to market have a far easier time getting off the ground.

When founders are able to raise capital at an earlier stage, they have more leeway to make important decisions, such as hiring the company’s first significant personnel. This allows them to take their time finding solutions and implementing their plans.

Pre-seed investment rounds are useful for investors because they allow them to scout promising new companies and give a boost to product development in firms whose products are consistent with the founders’ theses and have the ability to scale.

Investments made at the pre-seed stage still involve some degree of risk, but because the stakes are lower, more backers can afford to play. Consequently, the portfolio as a whole is protected to some extent against unanticipated events.

How Can Wellness Founders Boost Pre-Seed Funding?

Founders who are interested in a pre-seed funding round have numerous avenues to investigate. Opportunity and resources may be abundant, given the rising number of entrepreneurs in the country and their tremendous success.

However, it might be costly when seeking finance on the basis of nothing but concepts and plans.

Pre-seed funding typically comes from a wide variety of people, including friends and family, former coworkers, and angel investors. Pre-seed investment has become increasingly accessible in recent years, thanks to VC accelerator programs and foreign crowdfunding sites.

The founders’ interest is piqued by the problem’s specifics, the market’s potential, and the possibility of a workable solution. If the founders can communicate the potential to everyone, even if the technology is complex, they may be able to secure pre-seed capital.

Keeping investors interested and making the most of their money requires explaining the concept in detail, explaining how the money will be used, and demonstrating current accomplishments.

What Should Be Your Objective While Seeking Pre-Seed Capital For A Startup?

Before deciding on the target amount to raise, a plan is developed that details the measurable milestones that must be achieved and the resources required to do so. Pre-seed funding typically ranges from $50,000 to $250,000.

For investors, it is not worth their time to consider bids for amounts of money that are too little. However, without a minimum viable product (MVP), it will be difficult to earn significant revenue.

Final Thoughts

Excited to raise pre-seed funding for your wellness startup? Read on as we conclude the important steps you should take while preparing to launch a funding round:

- As a first step, you must collect and analyze data to demonstrate a compelling product-market fit. To succeed, businesses must ensure that their product is distinct from the competition and that it meets customer demand in a way that no other option does.

- Wellness founders need to learn the hard way that there’s no replacement for following through on their promises. There will always be a plethora of fantastic investment possibilities open to you if you are consistently achieving your model’s goals, innovating, and creating a rabid brand culture.

- Don’t take on investors who don’t share your values and goals. An unsuitable investor can cause significant disruption. However, a value-adding investor can be quite beneficial. Many people are eager to lend a hand because they wish to contribute to a worthwhile cause. You need to track them down.

Pre-seed fundraising is a crucial phase in the process of securing investors for a firm. Moreover, it is challenging because you likely have only a minimum viable product and no market experience to speak of.

The truth is, you’ll have to put in far more effort to find investors prepared to commit to your firm at this level, but it’ll be well worth it. Early investor partnership funding might provide a substantial advantage over competitors.

If you’re looking to grow your wellness, skincare, and cosmetics brand so you can land funding or attract more customers, Aventive Studio can take your business to the next level with our brand strategy, packaging design, visual identity, and website design services.

Learn more about our offerings and how we can help your business here, then reach out to our CEO & Creative Director to hop on a call about starting your wellness branding project today.